Loading...

Healthcare is a key area of focus for us in our transformation journey. As a leading life insurance provider in Singapore, we have a responsibility to ensure Singaporeans have access to affordable healthcare insurance in the long term.

To address the problem of rising medical costs and claims, we introduced the industry’s first claims-based pricing approach for private hospitalisation plans. We believe that in the long run, claims-based pricing will encourage more prudent use of medical services and help contain rising healthcare costs.

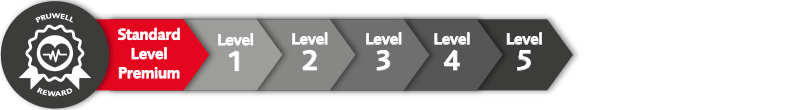

Claims-based pricing is a fairer pricing approach in that the IP rider premium will be determined based on a customer’s claims experience in private or public hospitals. There are different levels of pricing under claims-based pricing starting at the lowest premium level of your age band (Standard Level Premium).

Your future premium level may stay or change depending on the claim amount made during the Review Period. Claims-based pricing currently applies to our PRUextra Premier private hospital IP rider. Customers who stay healthy and don’t make any claims enjoy a 20% PRUWell reward.