Executive summary

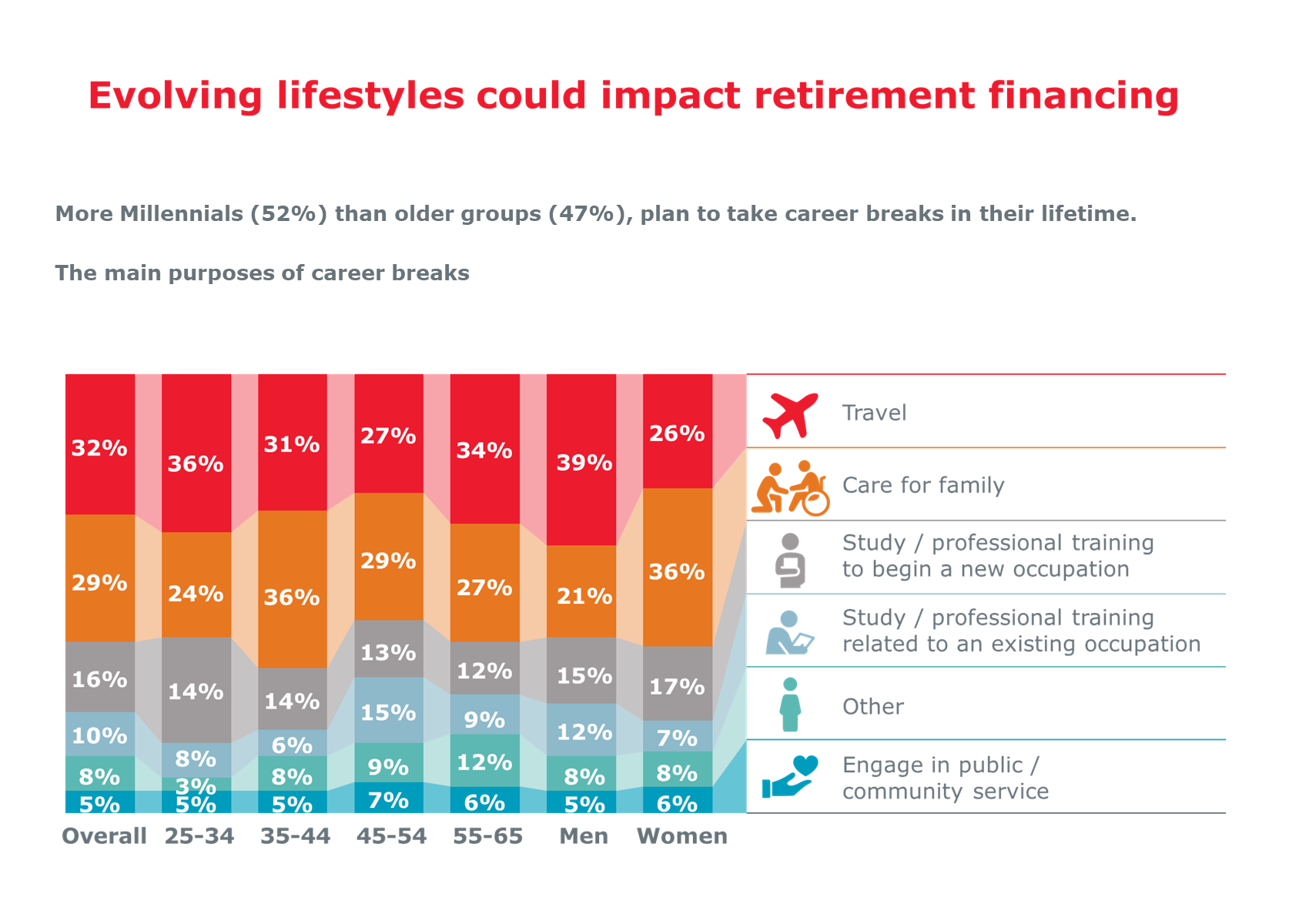

As Singaporeans live longer, assumptions they may have held about the traditional, sequential progression of life stages no longer hold sway.

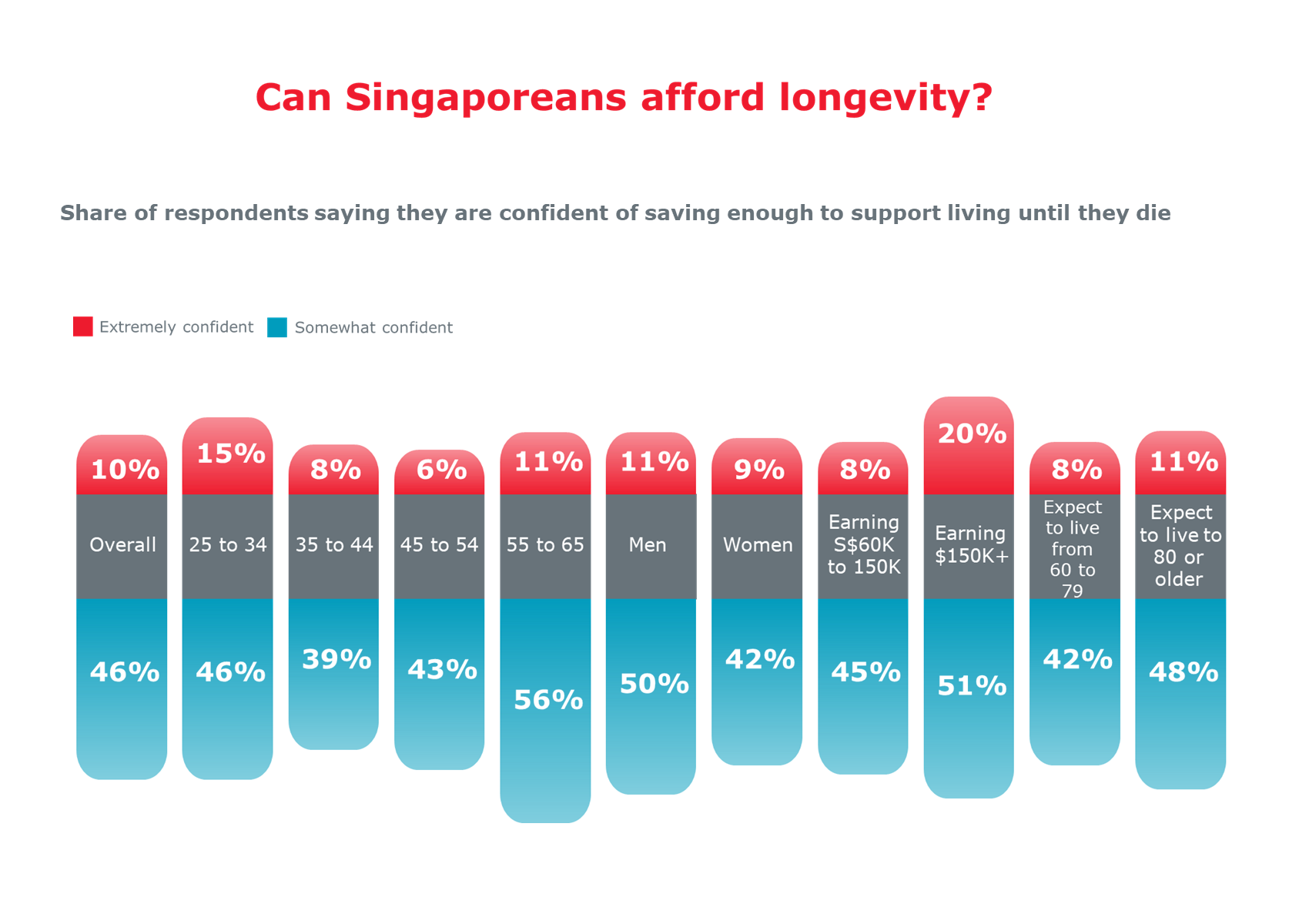

We surveyed over 1,200 residents of the city-state to understand their hopes, worries and plans for financing their older age as many look forward to living into their 80s, 90s and even beyond. Over half (56%) of respondents expressed confidence that they have already saved, or will be able to save, enough to support living until they die. That, however, leaves 44% who think otherwise, and the majority’s confidence is likely to have been dented as the covid-19 crisis has deepened. There are already real concerns evident in the survey, particularly among millennial-age Singaporeans, that financing older age will grow increasingly tough.

About the research

Saving for 100 : Funding longevity in a time of uncertainty is an Economist Intelligence Unit report, commissioned by Prudential Singapore. It explores the financial challenges Singaporeans face as life expectancy rises and how they plan to manage their wealth in anticipation of living a longer life. It also considers the implications of the covid-19 crisis for people’s ability to save for longevity. The analysis is based on a survey of 1,219 Singapore residents conducted in February and March 2020.