If you’re an existing account holder of a Current or Savings Account of UOB, simply reach out to your UOB banker and complete the online form below to enjoy the coverage.

Otherwise, please feel free to visit any UOB branch to find out how you can enjoy this privilege.

What is PRUTraveller Protect?

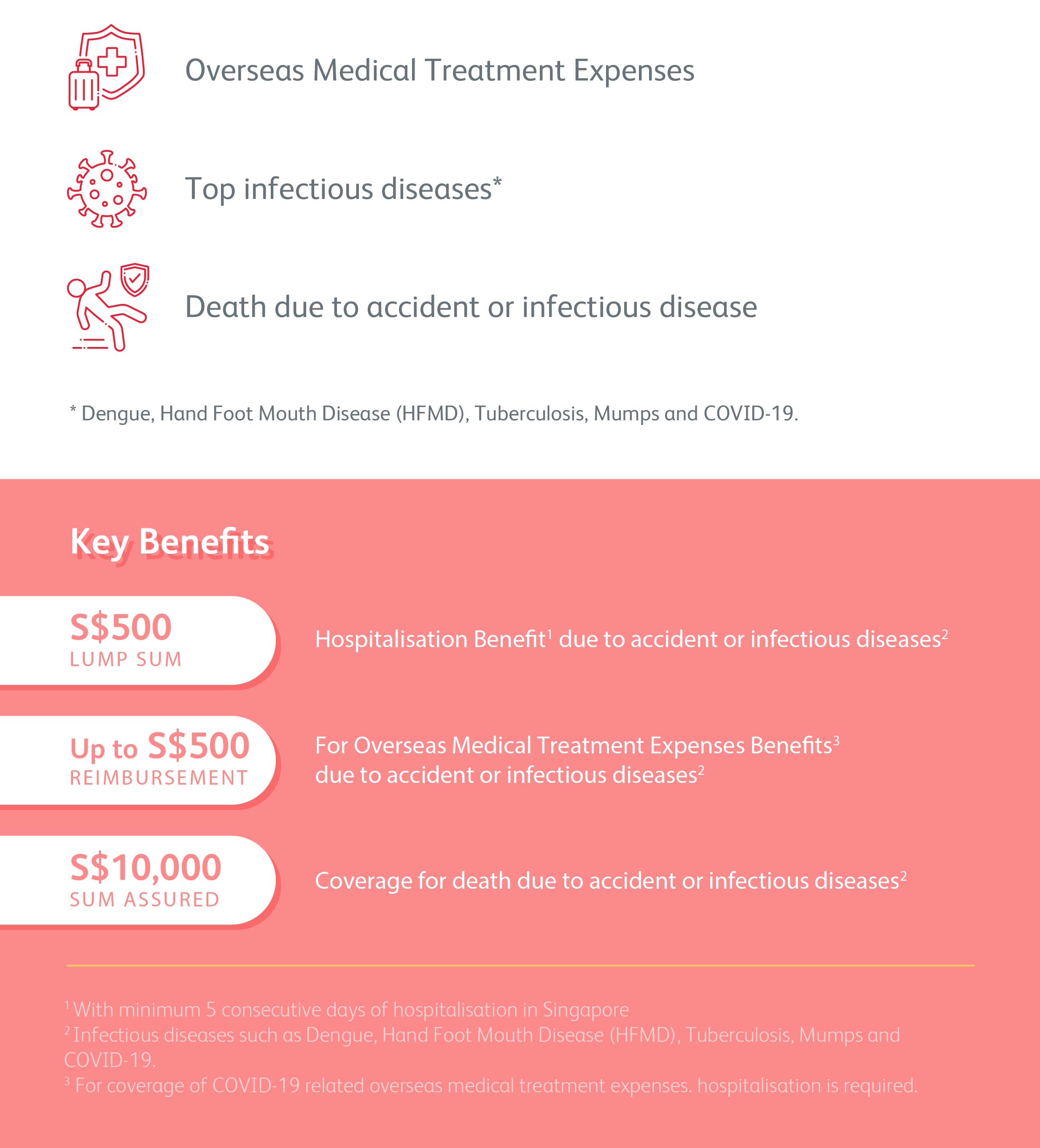

PRUTraveller Protect provides Personal Accident and Infectious Disease coverage against mishaps wherever you are, including overseas medical treatment and hospitalisation benefits.

Benefits

- S$500 one-time lump sum Hospitalisation benefit due to accident or infectious diseases1 when hospitalised in Singapore

- Reimbursement of up to S$500 for Overseas Medical Treatment Expenses2 due to accident or infectious diseases1

- S$10,000 sum assured cover for death due to accident or infectious diseases1

1Infectious Diseases refers to Dengue, Hand Foot Mouth Disease (HFMD), Tuberculosis, Mumps and COVID-19.

2For coverage of COVID-19 related overseas medical treatment expenses, hospitalisation is required.

Coverage Period

- 6 months from application date

Eligibility

Applicants must fulfil all of the following criteria:

- You must be an existing account holder of a Current or Savings Account with UOB.

- You must be a Singapore resident with a valid NRIC/FIN between the age of 18 and 65 years old (as at last birthday).

- One whose coverage for this policy had not been terminated previously.

Important Notes

This is only product information provided by us. You should seek advice from a qualified advisor if in doubt. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs.

This website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to this insurance product in the policy contract.

The information contained on this website is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

Most benefits of this plan will only be payable upon the occurrence of an accident.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

The information is correct as of 1 Feb 2023.

For more details on health insurance, visit LIA Your Guide to Health Insurance at https://www.lia.org.sg/tools-and-resources/consumer-guides/2020/your-guide-to-life-insurance/

For more information on PRUTraveller Protect, please call us at 1800 835 9733 today.

You can download your PRUTraveller Protect Product Summary here.

Frequently Asked Questions

How do I sign up?

You can sign up at the “SIGN UP NOW” button on this page.

What are the key features of the PRUTraveller Protect?

This is a voluntary group personal accident plan with added coverage for infectious diseases and overseas medical treatment.

You will receive reimbursement of up to S$500 under Overseas Medical Treatment Expenses Benefit* AND/OR a one-time S$500 lump sum Hospitalisation Benefit for hospitalisation due to accident or infectious disease in Singapore.

*For coverage of COVID-19 related overseas medical treatment expenses, hospitalisation is required.

You will also be covered under this policy for death due to accident or infectious disease, with a sum assured of S$10,000.

Who is eligible for the PRUTraveller Protect?

You are eligible to enrol in PRUTraveller Protect if you are an existing account holder of a Current or Savings Account with UOB. You must also be a Singapore resident with a valid NRIC/ FIN between the ages 18 to 65 (as at last birthday).

Each Eligible Member will only be incepted for one (1) PRUTraveller Protect plan.

How long will this campaign last?

The campaign is valid from 1st February – 31st December 2023.

Do I have to pay for this policy?

No payment is required.

When will my coverage commence and how long will I be covered under PRUTraveller Protect?

Your coverage will commence from the date you successfully sign up for 6 months, limited to the first 1,000 policies only, on a first-come-first-serve basis. Prudential will only issue the Certificate of Insurance (COI) via email to the successful applicant of PRUTraveller Protect within one (1) month from the date of sign up. No replacement of the COI will be given if invalid or inaccurate email addresses are provided. Please note that PRUTraveller Protect is not renewable.

What will I be covered for under the Overseas Medical Treatment Expenses benefit?

We will reimburse up to S$500 if insured member requires inpatient and/or outpatient medical treatment(s) due to accident or infectious disease, in an overseas hospital or registered medical practitioner clinic.

For overseas COVID-19 related medical treatment expenses reimbursement, hospitalisation is required.

For details, please refer to the product summary.

What will I be covered for under the Death benefit?

In the event of an accident or infectious disease where the insured member sustains an injury or sickness and subsequently dies, we will pay the full sum assured of the benefit.

Coverage shall apply for death that occurred in both Singapore and overseas.

For details, please refer to the product summary.

What will I be covered under the Hospitalisation Benefit?

We will pay a one-time lump sum of S$500 if insured member sustains an injury or sickness due to accident or infectious disease and requires hospitalisation in Singapore for a minimum of 5 consecutive days.

This benefit will only be paid once.

“Hospital” means a licensed, lawfully operating institution duly constituted and registered as a Hospital with the Ministry of Health in Singapore or, in the case of a hospital overseas, is registered with its local health authority, to care and treat sick or injured bed patients. It must have facilities for diagnosis, major surgery and a 24-hour a day professional nursing service supervised by one or more Registered Medical Practitioners. This definition excludes any institution operating as a convalescent or nursing home, rest home, community hospital, home for the aged, a place for alcoholics or drug addicts and psychiatric hospitals, which are primarily for the treatment of mental illness and/or psychiatric disorders or any similar purpose.

For details, please refer to the product summary.

Is there any waiting period?

- We will not pay for any claim incurred in respect of any Insured Member relating to Hospitalisation Benefit, Overseas Medical Treatment Expenses Benefit and Death Benefit, directly or indirectly, for, caused by, arising from or is in any way attributed to Dengue Fever, Hand Foot Mouth Disease, Mumps, Tuberculosis and COVID-19 within the first 21 days from the Cover Start Date. This refers any signs and symptoms suffered by the Insured Member which commenced within the first 21 consecutive days from the Cover Start Date.

- If the Insured Member sustains any injuries or sickness before the Cover Start Date, we shall not pay for the Ioss.

How do I make a claim?

To make a claim, please download the claims form and email the completed form to us at SGP.ES.Claims@prudential.com.sg. The original form should also be mailed to: Prudential Assurance Company Singapore (Pte) Limited Singapore Post Centre Post Office PO Box 399 Singapore 914014. You can also call 1800 835 9733 to check on the status of your claim.

Is this PRUTraveller Protect renewable?

No, the PRUTraveller Protect plan is non-renewable and only has a 6-month coverage period.