The COVID-19 vaccine is being rolled out in phases in Singapore, with priority being given to those who are at a higher risk1. The authorities are doing their best to ensure that there are no delays in the process of vaccinating the masses. Our Prime Minister, Lee Hsien Loong addressed the nation on May 31st and thanked the nation for their cooperation in social distancing to keep infection rates low2. He emphasized the need for extensive testing and assured everyone of faster delivery of the vaccine over the coming two months.

While the availability of the COVID-19 vaccine is indeed a huge relief, there is some concern about the side effects being reported. After having received their dose, some people have reported symptoms such as:

- Fatigue

- Body aches

- Fever

These symptoms are often mild; however, there have been reports of severe reactions like anaphylaxis. The possibility of these reactions has left many worried about how they will be affected by the vaccine.

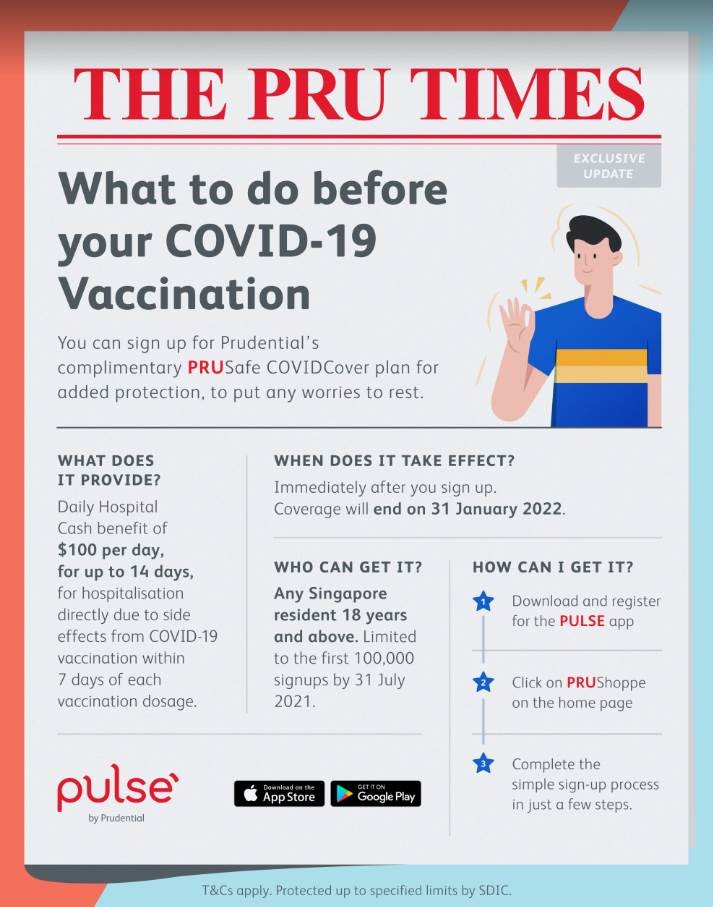

PRUSafe COVIDCover for coverage against COVID-19 vaccine side effects

You can now get COVID-19 vaccine insurance to stay covered against the side effects of the COVID-19 vaccine. This complimentary insurance product will cover you in case you are hospitalised due to side effects resulting from either of your vaccine doses.

Under this plan, you will be paid a daily hospital cash sum for each day you are hospitalised, subject to a maximum of 14 days for each COVID-19 vaccine dose. The daily hospital cash sum can be used for meeting additional expenses that arises during the period of hospitalisation.

The coverage is open to Singaporean citizens, permanent residents, and foreigners who have valid passes. Your coverage will be valid up to 31 January 2022, but you will need to ensure that that policy is active before you get vaccinated.

Do I need COVID-19 vaccine insurance if I have an Integrated Shield Plan?

You may have this question in mind since your Integrated Shield Plan also covers hospitalisation due to COVID-19 vaccine side effects. The COVID-19 insurance coverage can actually work as a supplement to your health insurance plan. You can let your Integrated Shield Plan take care of the hospital expenses and use the daily cash sum from your COVID-19 insurance coverage to meet other expenses that may not be covered, such as transport to the hospital, meals, and so on.

How to sign up for PRUSafe COVIDCover?

You can easily sign up for PRUSafe COVIDCover through a health app (Pulse by Prudential). All you need to do is to download the app from Google Play Store or Apple’s app store and sign up with a few clicks. Additionally, there is no requirement of any medical underwriting for availing insurance coverage against COVID-19 vaccine side effects.

You can also raise claims easily through the app. In these days of social distancing, the availability of insurance online is truly convenient!

In conclusion

If you have any specific queries about the impact of the vaccine on your own health, do speak to your doctor. Remember that COVID-19 can lead to many health complications for you and your loved ones. Make a wise choice to stay protected by getting your dose of the vaccine. With Covid-19 vaccination insurance coverage, you do not need to worry about potential financial costs from the side effects.

Source:

1https://www.moh.gov.sg/covid-19/vaccination

2https://www.channelnewsasia.com/news/singapore/pm-lee-full-speech-covid-19-new-normal-heightened-alert-14919816

Disclaimer

This article is for your information only and does not consider your specific investment objectives, financial situation or needs.

Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs.

The information contained on this article is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 23 June 2021.