Have you done your income tax yet?

If you are reading this, you probably have not, or you are worried about how you should get it done. But no worries, because here is all you need to know about tax filing and after this, you will have all the necessary information you will need to get that done.

Income Tax, in Singapore, consists of both individual and corporate income tax. The amount that you get taxed ranges based on your income or profits and varies based on your living characteristics.

Individual income tax is payable on an annual basis and is based on the progressive tax system, with taxes ranging from 0% to 22% of your income. Similarly, corporate income tax is done the same.

Check Out Which Platform to Fill Out Your Tax.

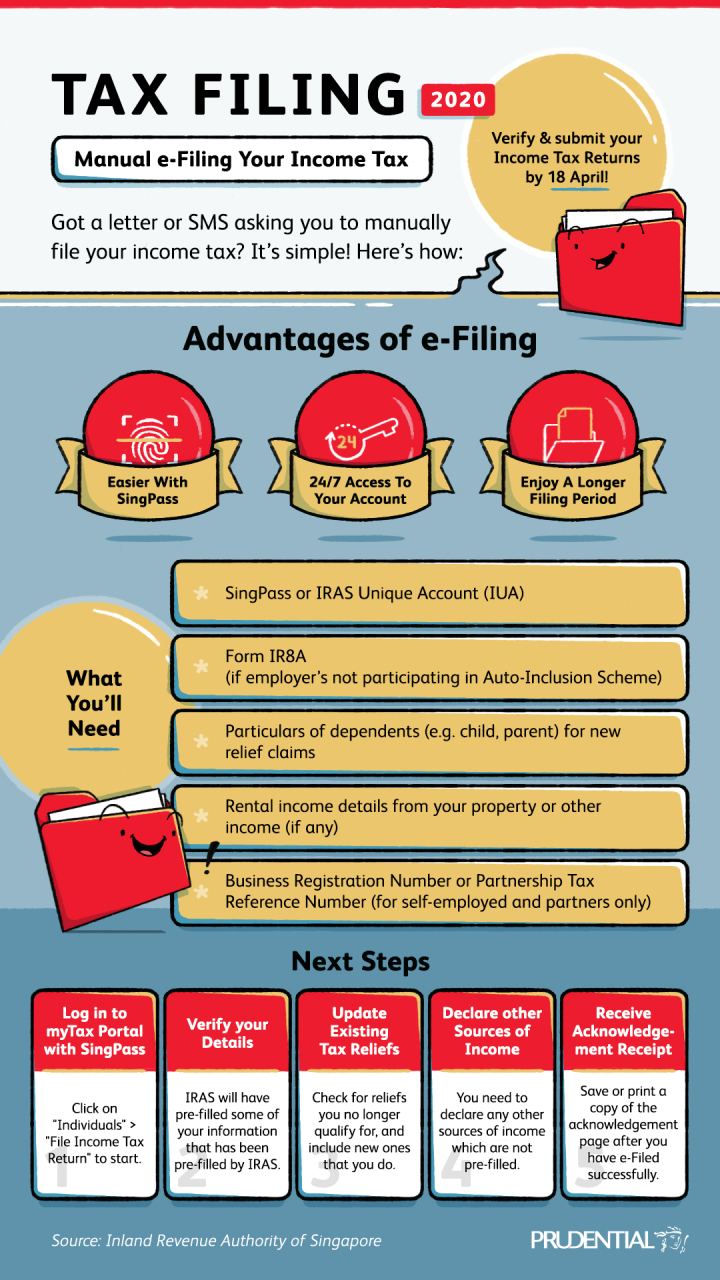

If you received a letter or SMS asking you to manually fill out your income tax, here is how you can do so online. Log onto the myTax portal with your SingPass and check through your pre-filled information.

Next, check on your reliefs and declare all your income sources. When you are done, you should receive an Acknowledgment Receipt. As simple as that, you have completed your income tax filing for the year.

Tax Relief Deductions

Before paying for your taxes, it is best to check out which tax reliefs you are eligible for and indicate so. Tax reliefs are given by the government to help lower the amount of income you will be taxed on, and this means you pay lower taxes. Here are some of the more common income tax reliefs available:

- Tax deductions for donations

- Tax deductions for parents

- Tax deductions for life insurance

- Tax deductions for CPF

The detailed list of the different tax reliefs can be found on the IRAS webpage, including the different eligibility criteria. However, it is important to research prior on the reliefs that you are eligible for, as it varies with different individuals.

Easy and Convenient Online Income Tax Filing

E-filing is a new and efficient way of getting your income tax filing done. With a SingPass, it is easy to log in and verify your identity at any time of any day. The myTax portal is open 24/7 for easy and convenient access. With this, you can enjoy a longer filing period.

After filing, don’t forget to make payments via GIRO or one-time payment (Debit or Credit cards).

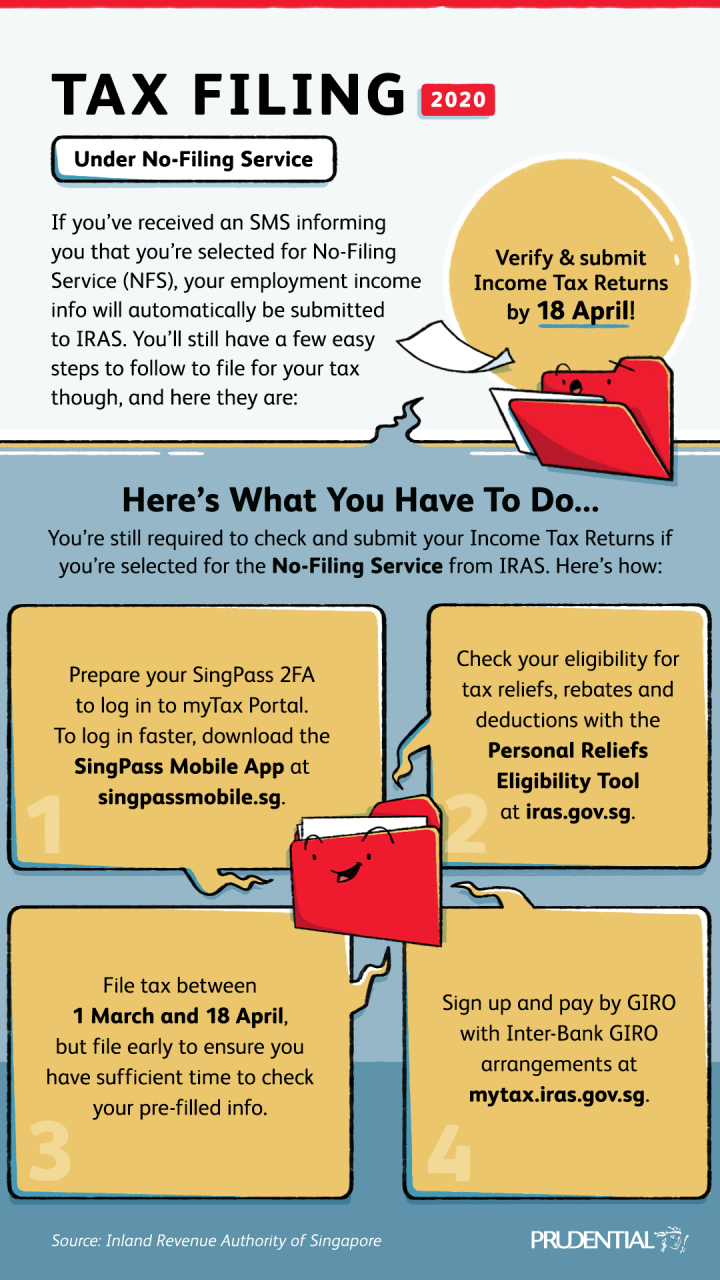

What is No-Filing Service (NFS)?

If you are informed via SMS that you are selected for No-Filing Service (NFS), your employment income has already been automatically sent to IRAS, and you need not do any tax filing.

Please note, you would still need to check your tax filing details in the myTax portal and make sure all your reliefs, rebates, and declaration are made. You can use the myTax portal to do so with your SingPass.

Filing Your Taxes on Time is Essential.

Over the years, many individuals have been charged for filing their taxes late, or completely ignoring the need to do so. But there are repercussions. Based on Singapore law, one may be charged a late filing fee not exceeding SGD$1000, estimated Notice of Assessment (NOA), and a summon to court.

Hence, if you want to avoid all that blacklisting and trouble, file your taxes on time. Other than that, filing your taxes promptly helps you to manage your finances and income well. It is crucial to thoroughly check when and if you need to do your tax filing.

Tax filing might be a chore and burden for some, but getting it done and dusted would be way more effective than leaving it to the last minute. If you do not want to forget to settle your income tax for the year, head down to the myTax portal now to get yours done today so you would forget about it tomorrow.

Disclaimer:

Certain information in this article may be taken from external sources, which we consider reliable. We do not represent that this information is accurate or complete and should not be relied upon as such. This article is for your information only and should not be taken as tax advice. Please seek independent tax advice if necessary.