With the rising costs of living and healthcare1 in Singapore, parents often worry about what is considered an adequate amount of coverage and protection for their child. Here is a guide for parents on the different types of insurance products that are available for your child.

1. Integrated Shield Plans with Riders

Parents should not have to worry about hefty medical bills while their child is admitted in hospital. As children have the tendency to fall sick and get injured, it is good to be prepared.

Here’s a breakdown of how much hospitalisation can cost in Singapore if a child is admitted.

|

Hospital |

|

|

KK Women’s and Children’s Hospital "class="editorial-body-copy"> |

$300-$2,737 depending on the ward admitted |

|

National University Hospital |

$263 - $3,607 depending on the ward admitted |

|

Gleneagles Hospital |

$1,899 - $6,952 depending on the ward admitted |

|

Mount Alvernia Hospital |

$2,190 - $6,063 |

|

Mount Elizabeth Hospital |

$2,479 - $7,000 |

|

Mount Elizabeth Novena Hospital |

$2,886-$6,697 |

|

Parkway East Hospital |

$1,903 -$5,252 |

|

Raffles Hospital |

$2,837-$5,596 |

Source: Singapore Motherhood, 2017

If your child is Singaporean or Permanent Resident, then he or she will be covered by MediShield Life, a basic health insurance plan administered by the Central Provident Fund (CPF) Board.

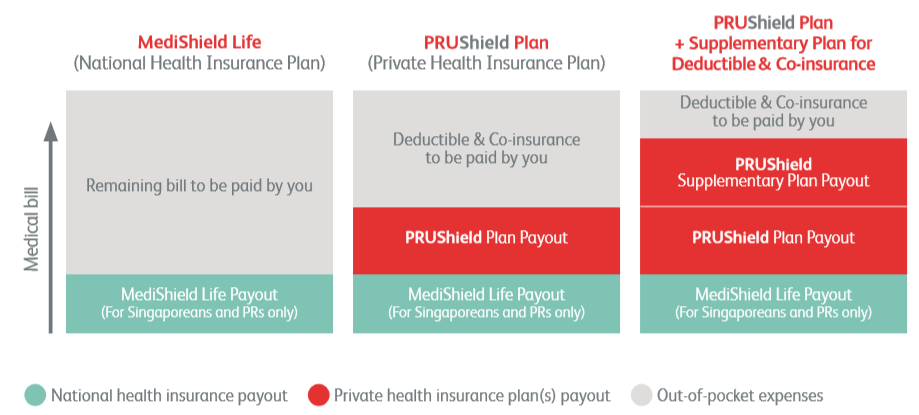

Many parents prefer to complement their MediShield Life with a private Integrated Shield Plan (IP) to get better protection and healthcare services for their children.

The table illustrates how a private IP supplements MediShield Life coverage, using PRUShield as an example:

|

|

MediShield Life |

PRUShield |

|

Ward Class the payouts are based on |

Class B2/C wards in public hospitals (6-bedded / 8-bedded wards) |

Class A ward (single-bedded ward) in public hospitals & all private hospitals |

|

Pre- and Post- Hospitalisation |

✗ |

✓

|

|

Claim limit on each benefit |

There is a cap on each benefit |

Covers full amount indicated on bill, subject to deductible* and co-insurance** |

|

Total maximum claim limit |

S$100,000 |

Up to S$1.2m |

Subject to policy terms and conditions.

*Deductible: A fixed amount to be paid by a policyowner before any PRUShield benefits are paid out.

**Co-insurance: A percentage of the claimable amount that a policyowner needs to co-pay after deductible

Aside from getting an IP, you can consider adding on a rider to reduce your co-insurance and. deductibles. Some riders such as PRUExtra Preferred CoPay and PRUExtra Premier CoPay have value-added services that parents may find comforting.

Source: Prudential PRUShield Product Brochure

2. Personal Accident Plan

It’s hard to keep an eye on your child 24/7, especially for working parents or parents with more than one child. Sometimes, accidents may happen, and it’s not because you are not doing your best, but children tend to have lesser awareness on danger and hygiene.

A personal accident plan for your child complements existing hospitalisation or medical insurance to ensure coverage in the event of an accident.

*What is covered under PRUPersonal Accident?

- Injuries and accidents

- Food poisoning

- Infectious diseases such as Dengue and HFMD

- Animal and insect bites

3. Life Insurance

There are two types of life insurance, term and whole life.

Term insurance is typically more affordable as compared to whole life insurance as it only offers coverage for a certain amount of years. However, once the policy expires, your child would need to get a new one and there may be difficulties in purchasing a new policy if the child develops a health condition.

Whole life insurance provides coverage for entire life such as our PRUActive Life. As whole life insurance premiums increase with age, your child will reap the benefits of lower premiums in the long run.

While parents can purchase life insurance after the birth of their child, some insurers offer bundled Maternity to Baby plans that can be purchased when the mother first becomes pregnant*. The life policy is then transferred over to the child after birth, without underwriting. Learn more about our bundled maternity insurance plan - PRUFirst Promise.

Purchasing insurance for your child is a major decision between parents and it is a long-term commitment. If you are unsure about what types of insurance and policies to purchase and what best suits the needs of you and your family, speak with your Prudential Financial Consultant today.

Read more here on major financial decisions to make for a growing family.

1Healthcare spending on the rise because of higher utilisation, rising manpower costs: Gan Kim Yong. (2020) Retrieved from https://www.channelnewsasia.com/news/singapore/healthcare-spending-rise-higher-utilisation-manpower-costs-12504664

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This article is for your information only and does not consider your specific investment objectives, financial situation or needs. We recommend that you seek advice from a Prudential Singapore Financial Consultant before making a commitment to purchase a policy.