Tougher to deliver par funds’ projected non-guaranteed bonuses amid low interest rates, stricter risk-based capital framework

A persistent low interest rate environment and a tougher risk-based capital framework would make it harder for Singapore life insurers to deliver the projected non-guaranteed bonuses linked to participating or par funds, even though most of the 10 key life insurers are able to at least support any such payouts.

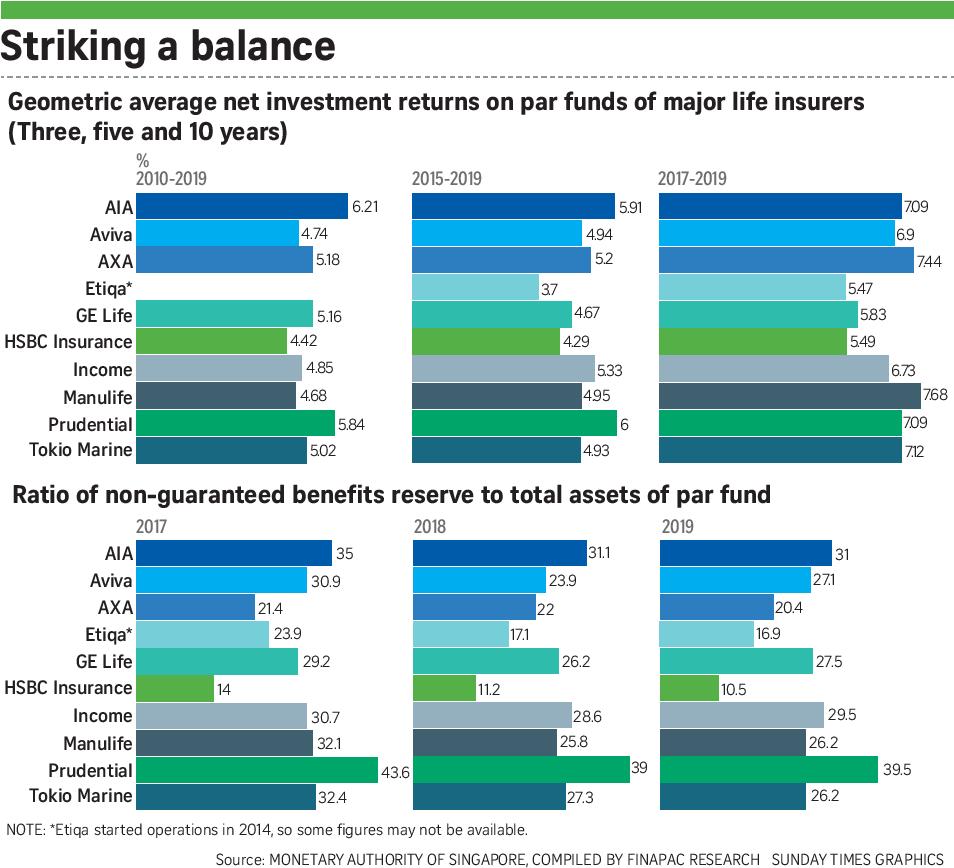

Based on insurers’ 2019 returns that were filed with the Monetary Authority of Singapore (MAS), Manulife Singapore, Prudential Singapore and AIA Singapore topped the geometric average net investment returns for par funds for the three-year, five-year and 10-year periods respectively.

Manulife topped the 2017-2019 period at 7.68 per cent, while AXA Singapore and Tokio Marine Life Insurance Singapore followed at 7.44 per cent and 7.12 per cent respectively, higher than the group average of 6.69 per cent.

Over a five-year period from 2015, Prudential took pole position with 6 per cent, followed by AIA with 5.91 per cent and NTUC Income at 5.33 per cent. The group average was 4.99 per cent.

The group average from 2010 was 4.61 per cent and AIA topped this category at 6.21 per cent.

Prudential followed at 5.84 per cent and AXA at 5.18 per cent.

Etiqa Insurance was operational in Singapore from 2014, so it has no 10-year average returns. The insurer pointed out that as a relatively new player, high growth of the total par assets would have distorted the ratio. To illustrate, in 2015, Etiqa’s cash holding was $22.2 million and investment assets (equities and bonds) were $29.8 million. This then resulted in lower investment income and, accordingly, lower returns, it said.

When asked, Manulife chief customer and product officer Darren Thompson said the firm diversified investments in recent years and the change in strategy has worked well so far.

Prudential chief investment officer David Chua said the firm uses “carefully curated fund strategies”.

The key consideration in insurers deciding the level of yearly reversionary bonus rates of par policies is investment performance.

There are other factors that weigh in, such as the expenses, claims and surrenders, but sources say these are more impactful for small par funds and less so for large and mature par funds like those of AIA, Prudential and Manulife.

They pointed out that the three-year average “carries more weight in determining bonus declarations” as it is more reflective of current trends. Those that perform well are also in a better position to weather storms.

Currently, the two projected investment rates of returns shown in the benefit illustration of par products are 3.25 and 4.75 per cent per annum. Of the three-year industry averages, all players clocked higher rates than the two projections listed.

Observers say pressure is building for a downward revision of the two projections in the light of increasing global volatility. The Life Insurance Association conducts an annual review on this.

Together with insurers’ average net investment returns, reserve ratios will paint a clearer picture for policyholders on whether insurers are likely to adjust non-guaranteed bonuses.

Reserve ratios are calculated by comparing an insurer’s reserve buffer against its total assets.

Data showed that from 2017 to last year, Prudential, which did not cut bonus rates for FY2019, had the highest buffer of between 39 per cent and 43.6 per cent, while HSBC Insurance’s reserve ratio slid from 14 per cent in 2017 to 10.5 per cent last year – the lowest of the 10 insurers.

“At HSBC Life Singapore, we regularly review our bonus payout for participating products. The aim is to ensure our customers will receive a stable return over time regardless of market conditions.” “It is also important to note that besides market performance, factors such as risk appetite of the insurer and product specifications including level of guarantees and risk passed on to customers would also impact par fund returns,” said the insurer.

It added that it has increased investments in alternative asset classes “which will diversify the portfolio and ultimately achieve better returns over the long term for our par policyholders”.

Etiqa, whose reserve ratio for the three years is mixed, attributed this to product mix, which players agree can have an impact. Looking ahead, observers cautioned that today’s low interest rate environment may impact future investment returns of par funds, and in turn lead to possibly lower reserve ratios that are an important factor in considering whether a dividend adjustment may be needed.

Together with the stricter risk-based capital framework known as RBC2 now in place, it is more costly for insurers to manage par funds and to balance between profitability and providing attractive returns to par policyholders, they said.

About half of the new business in Singapore’s life insurance industry come from par plans.

Mr Thompson said: “With lower interest rates, the amount of capital required to support products with high guarantees will be more. “This may just mean that insurance companies will have to innovate to find alternative innovative product solutions to support the needs of the customers.”

Asked if Prudential would change its asset mix to manage capital costs, Mr Chua said: “We have been implementing ways to better realise capital efficiency and manage the cost of capital. Any asset mix changes will take into account the possible implications to product guarantees to policyholders.”

Source: Life insurers' balancing act only gets harder, The Sunday Times, 8 November 2020, Pg B7

© Singapore Press Holdings Limited. Permission required for reproduction.

Ever wondered how your participating policies generate returns for you?

Watch our video here.