PRULink ActiveInvest Portfolio Fund

Has investing crossed your mind lately?

Have you been thinking about investing but find it daunting, complex and time-consuming or are you afraid of investment losses and hence have not taken the first step?

We hear you, whether you are an expert or newbie, investment often requires time and effort to research, understand complex terms, and continued monitoring to ensure you make the most out of your investment.

Introducing PRULink ActiveInvest Portfolio Fund - here to make your investment journey easy and hassle-free.

It offers you the choice of four diversified portfolio funds that cater to various risk appetites and aims to provide long term sustainable returns. Managed and guided by Prudential’s investment experts, the portfolios constructed are robust and diversified to achieve optimal returns within its risk limits.

Knowing that your wealth is well-managed by the experts, you have the support needed to reach your financial goals at any life stage and dedicate more time to more important things in life.

Key Benefits

You should consider PRULink ActiveInvest Portfolio Funds if

Four actively managed portfolio funds for

you to choose from

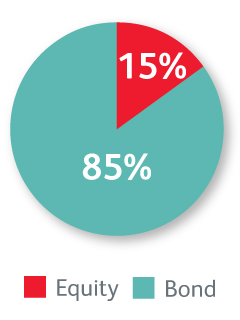

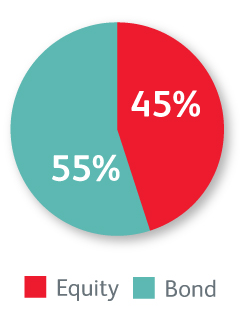

PRULink ActiveInvest Portfolio Fund – Conservative2

(Lower Risk)

The investment objective is to provide conservative and stable returns by investing in a broad range of underlying funds.

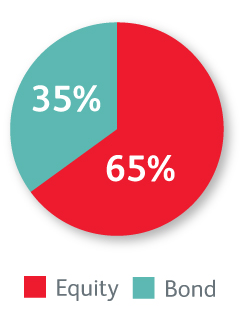

PRULink ActiveInvest Portfolio Fund – Moderate2

(Low to Medium Risk)

The investment objective is to achieve moderate returns by investing in a broad range of underlying funds.

PRULink ActiveInvest Portfolio Fund – Balanced2

(Medium to High Risk)

The investment objective is to achieve balanced capital growth by investing in a broad range of underlying funds.

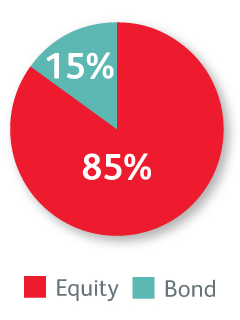

PRULink ActiveInvest Portfolio Fund – Growth2

(Higher Risk)

The investment objective is to achieve high growth by investing in a broad range of underlying funds.

Important Information

Footnotes

- Refers to Continuing Investment Charge.

- The presented asset allocation of the portfolio funds is for illustration purposes only. The asset allocation may vary depending on market conditions and outlook. There will be regular reviews and rebalancing of the portfolio to generate the most optimal combination of risk and return against the market outlook.

Important Notes

A potential investor should read the Product Summary, Fund Information Booklet and Product Highlights Sheet before deciding whether to subscribe for units in the Fund and seek professional advice before making any investment decision. In the event that investor chooses not to seek advice, he/she should consider carefully whether the Fund in question is suitable for him/her.

There is no assurance that any securities/funds discussed herein will remain in the portfolio of the Fund at the time you receive this material or that securities sold have been repurchased. The securities/funds discussed do not represent the Fund’s entire portfolio and in the aggregate may represent only a small percentage of the Fund’s portfolio holdings.

Investments are subject to investments risks including the possible loss of the principal amount invested. The prediction, projection or forecast on the economy, securities markets or the economic trends of the markets targeted by the Fund are not necessarily indicative of the future or likely performance of the Fund. The past performance of the Manager or Investment Manager and the Fund is not necessarily indicative of its future performance. The performance of the Fund is not guaranteed and the value of the units and the income accruing to the units, if any may fall or rise.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 15 December 2023.

This advertisement has not been reviewed by the Monetary Authority of Singapore.