Early Crisis Multiplier Flex

Enjoy enhanced protection against the early stages of critical illness

When it comes to your family’s future, you can never leave anything to chance. Critical illness can occur at any stage of life. That is why, we offer you enhanced protection with Early Crisis Multiplier Flex.

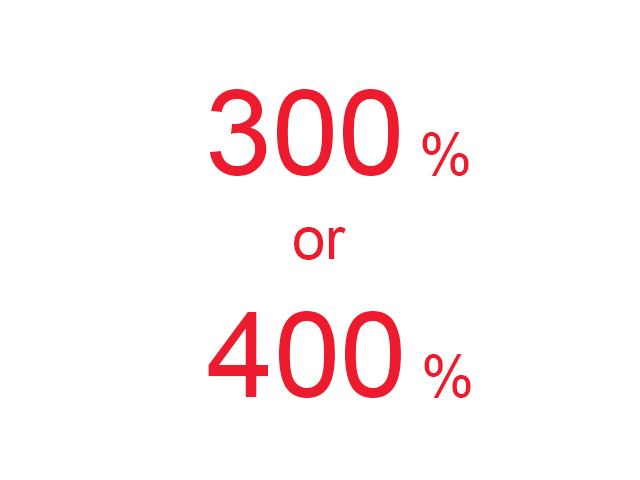

As a supplementary benefit to PRUlife multiplier flex plan, it gives you multiplied coverage1 of up to 4 times for Early and Intermediate Stage Medical Conditions2.

So protect yourself and your family with greater coverage today.

Highlights

Product Details

Product Features

| Payment Term |

Limited Premium3:

|

| Policy Term |

Whole of Life |

| Issuance Age |

1 to 60 Age Next Birthday |

| Accidental Death Benefit |

Not Applicable |

| Sum Assured |

Minimum Sum Assured: $10,000 Maximum Multiplier Benefit: $350,000 |

| Core Benefits |

|

How it works and Medical Conditions:

How it works:

Multiplier Benefit at a glance:

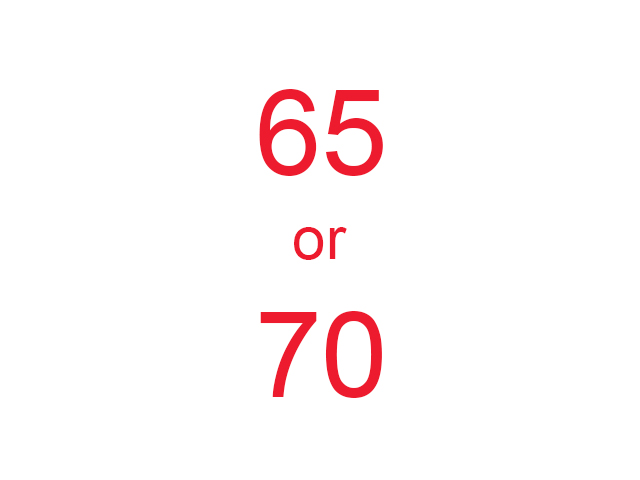

| Plan Type | Multiplier Benefit Expiry Age |

Multiplier Benefit+ for Early Crisis Multiplier Flex before the Multiplier Benefit Expiry Age |

| Early Crisis Multiplier Flex 65 3x | 65 years | 300% |

| Early Crisis Multiplier Flex 65 4x | 65 years | 400% |

| Early Crisis Multiplier Flex 70 3x | 70 years | 300% |

| Early Crisis Multiplier Flex 70 4x | 70 years | 400% |

+ Multiplier Benefit is the relevant percentage of the sum assured.

Medical Conditions:

List of covered Medical Conditions

| Critical Illnesses Covered Under PRUlife multiplier flex | Medical Conditions covered under Early Crisis Multiplier Flex |

|

| Early Stage Medical Conditions | Intermediate Stage Medical Conditions | |

|

Moderately severe Alzheimer’s Disease or Dementia |

- |

|

Surgical removal of pituitary tumour or Surgery for subdural haematoma |

- |

|

Loss of sight in one eye | Optic Nerve Atrophy with low vision |

|

Coma for 48 hours | Severe Epilepsy or Coma for 72 hours |

|

Keyhole coronary bypass surgery or Coronary Artery Arthrectomy or Transmyocardial Laser Revascularisation or Enhanced External Counterpulsation Device Insertion |

- |

|

Partial loss of hearing or Cavernous sinus thrombosis surgery |

Cochlear implant surgery |

|

Surgical removal of one kidney or Chronic Kidney Disease |

- |

|

Liver surgery | Liver Cirrhosis |

|

Severe Asthma or Insertion of a Veno-cava filter |

Surgical removal of one lung |

|

Hepatitis with Cirrhosis or Biliary Tract Reconstruction Surgery |

Chronic Primary Sclerosing Cholangitis |

|

Cardiac pacemaker insertion or Pericardectomy |

Cardiac defibrillator insertion or Early Cardiomyopathy |

|

HIV due to Assault, Organ Transplant or Occupationally Acquired HIV |

- |

|

Moderately severe Parkinson’s Disease |

- |

|

Reversible Aplastic Anaemia |

Myelodysplastic Syndrome or Myelofibrosis |

|

Loss of Speech due to neurological disease or neurological injury or Permanent or Temporary Tracheostomy |

- |

|

Moderately severe burns | - |

|

|

Carcinoma in situ of specified organs treated with Radical Surgery |

|

Facial reconstructive surgery or Spinal cord injury |

Intermediate Stage Major Head Trauma |

|

Small bowel transplant or Corneal transplant |

- |

|

Early Motor Neurone Disease or Peripheral Neuropathy |

- |

|

Early Multiple Sclerosis | Mild Multiple Sclerosis |

|

Moderately severe Muscular Dystrophy or Spinal Cord Disease or Injury resulting in Bowel and Bladder Dysfunction |

- |

|

Percutaneous Valve Surgery |

- |

|

Minimally invasive surgery to Aorta or Large asymptomatic aortic aneurysm |

- |

|

Early Stage Other Serious Coronary Artery Disease |

Intermediate Stage Other Serious Coronary Artery Disease |

|

Loss of Use of One Limb | Loss of Use of One Limb requiring Prosthesis |

|

Early Pulmonary Hypertension |

Secondary Pulmonary Hypertension |

|

Early Progressive Scleroderma |

Progressive Scleroderma with CREST syndrome |

|

Bacterial Meningitis with full recovery |

- |

|

Viral Encephalitis with full recovery |

Moderate Viral Encephalitis with full recovery |

|

Brain aneurysm surgery or Cerebral shunt insertion |

Carotid artery surgery |

|

Mild Systemic Lupus Erythematosus |

- |

Footnotes and Note:

Footnotes:

- The Multiplier Benefit is the relevant percentage of the sum assured shown in the product summary. The selected Multiplier Benefit and its expiry age must be the same as that selected for PRUlife multiplier flex.

- Early Stage and Intermediate Stage benefits payout under Early Crisis Multiplier Flex will reduce the PRUlife multiplier flex policy sum assured. If the sum assured of both PRUlife multiplier flex and Early Crisis Multiplier Flex is the same and a benefit payout for 100% of the sum assured from Early Crisis Multiplier Flex is made, the PRUlife multiplier flex policy and the Early Crisis Multiplier Flex benefit will terminate. A claim under the Crisis Multiplier Flex benefit within the PRUlife multiplier flex policy could result in either a reduction of sum assured or termination of Early Crisis Multiplier Flex.

- The premium payment term must be the same as PRUlife multiplier flex's premium payment term.

- Once a claim has been made for a listed medical condition, the list of medical conditions covered would be reduced accordingly and the customer cannot make a repeat claim on the same listed medical condition. A claim on the Early and/or Intermediate Stage Benefit will reduce the sum assured of Early Crisis Multiplier Flex and PRUlife multiplier flex.

- Future premiums for Early Crisis Multiplier Flex will be waived after the first successful claim is made under the Early Stage Benefit and the claim does not pay out the full sum assured.

Note:

You are recommended to read the product summary and seek advice from a qualified Prudential Financial Consultant for a financial analysis before purchasing a policy suitable to meet your needs. This plan has no cash value. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. Premiums are not guaranteed and may be adjusted based on future claims experience.

This website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to this insurance product in the policy documents that can be obtained from your Prudential Financial Consultant.

The information contained on this website is for distribution in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. In case of discrepancy between the English and Mandarin versions of this brochure, the English version shall prevail.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policies is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as at 26 August 2020.

Next Steps